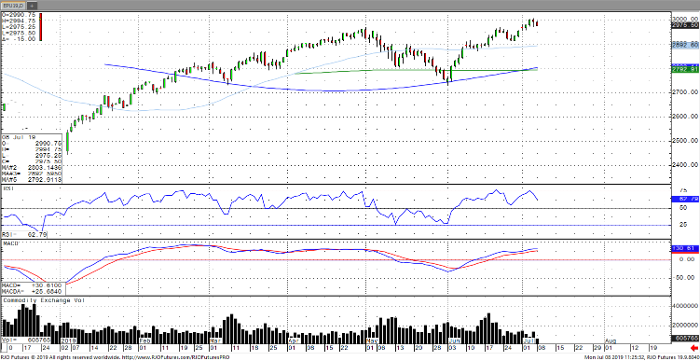

The U.S. equity market is following the Asian markets lower in the early session with the Shanghai Composite leading, down – 2.6% and the KOSPI down another -2.2% in the overnight (after being down -1.2% in last week). This comes amidst a strong jobs number last Friday tempering rate cut expectations, with the latest projection of a quarter rate cut at 92% according to the Fed-funds futures. This expectation has largely been priced into the market and with Greek yields pushing to record lows following a landslide election win, geopolitical concerns continue to persist. Notable events this week include a littering of Fed speak along with U.S. inflationary data, with expectations continuing to fall. The S&P 500 remains bullish trend with the current range seen between 2893 – 3011.

S&P 500 Sep ’19 Daily Chart