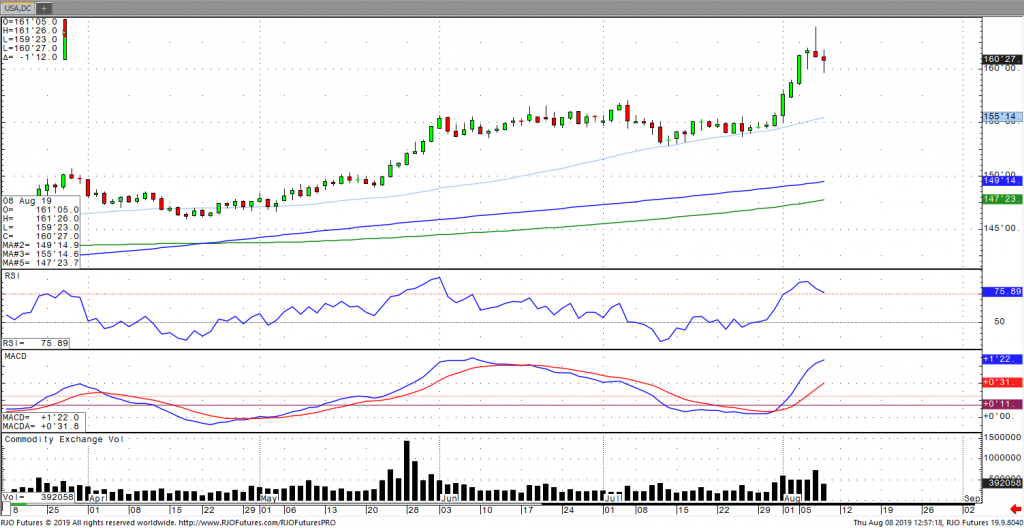

U.S. government bond prices are falling and coming off their bottleneck breakout following a report that German officials are considering implementing a fiscal stimulus package. This comes following new lows in U.S. yields after interest rate cuts by centrals banks in New Zealand, India, and Thailand this week. Easing policy typically weakens the respective country’s currency and supports their economies by making exports cheaper, which in turn leads to a stronger U.S. dollar. The Fed reduced rates by a quarter percentage point last month – the first cut since 2008 – to what Chairman Powell described was preemptive ‘mid cycle adjustment’ but expectations have increased sharply for further cuts as concerns regarding global growth continue to persist, coupled with ongoing and intensifying trade tensions. The benchmark 10- year yield remains bearish trend with today’s range seen between 1.61 – 1.91.