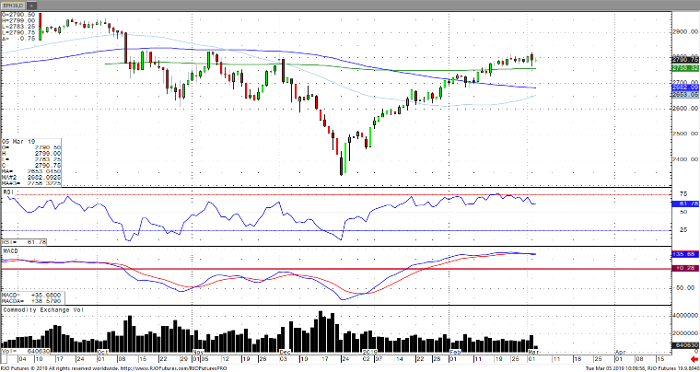

Global equity markets were able to find positive footing after a mixed session in Asia with U.S. equity markets awaiting reports on an impending U.S. – China trade deal. This comes as China’s government announced it would be providing more stimulus to stabilize slowing growth when it predicted its 2019 GDP target would fall to 6.0% to 6.5%. February Caixin Chinese Services PMI came in softer than expected. There were daily divergences in Asia as the Shanghai Composite posted a gain in the overnight while the Japanese Nikkei and South Korea Kospi indices closed with moderate losses, only further solidifying the decelerating growth across Asia. Despite January euro zone retail sales and February Markit services and composite PMI slightly higher than expected, recessionary risk remains across Europe with Italy already in a recession. The S&P 500 is coming off the highest level since November with the reversal action perhaps indicating a short-term peak. The market is immediate term overbought with resistance seen around 2818 with next levels of support seen around 2765 and 2740.

E-Mini S&P 500 Apr ’19 Daily Chart