US government treasury prices have continued their upside extension and regained momentum following a slight downtick in price on Tuesday, reaching their highest price since late March. This comes amidst a negative tilt in global growth risk with Chinese economic data confirming the recent bearish phase transition in the Shanghai Composite. Chinese economic data missed in the overnight with Retail Sales coming in at 7.2% (against +8.7% in March), which was the lowest since May 2003, and Industrial Production falling to 6.2% from +6.5% in March. This was coupled with a miss in US Retail Sales as well as sharp decline in Industrial Production -0.5% MoM, which showed the weakest growth in 2 years. Recent weakness in the US equity market amid ongoing trade tensions has sparked safe haven buying with the benchmark 10-yr yield falling as low 2.371%, with the latest expectation of a 45 bps rate cut this year. The yield on the 10-yr note remains bearish trend with the current range seen between 2.36 – 2.50%. Funds hold a large net spec short position which could fuel some short covering in the near-term with resistance on June bonds coming at 150-04.

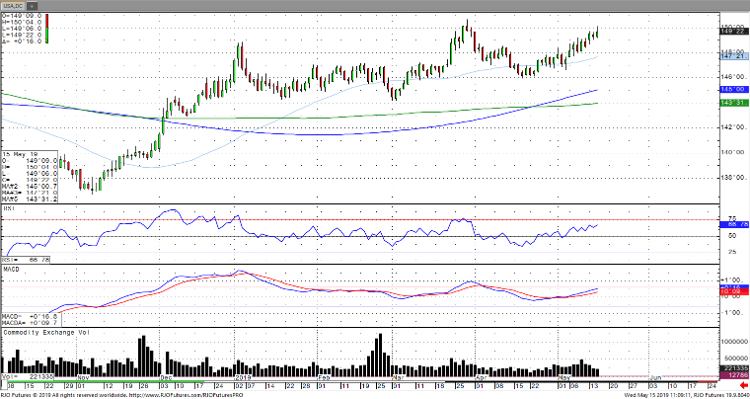

30-Year Treasury Bond Daily Chart