Pres Trump is calling for a 10M-15M Barrel cut – why not make it 25M!! LOL. You knew this was coming, he said it was coming last week actually in his daily press briefings. This will also be the case in stocks as well – President Trump will take to twitter and go ALL CAPS and get a nice pump out of the market. Regardless, we’ll keep managing the range of the market and stick to our process. Speaking of which, this is a nice bounce in crude to the top of our range, I’ll likely take a short position today. Super wide range of 18.70-27.40 (probably higher now as I write this) and a nasty 162 on the oil volatility (OVX). A 35% rally makes this a big fat juicy sell.

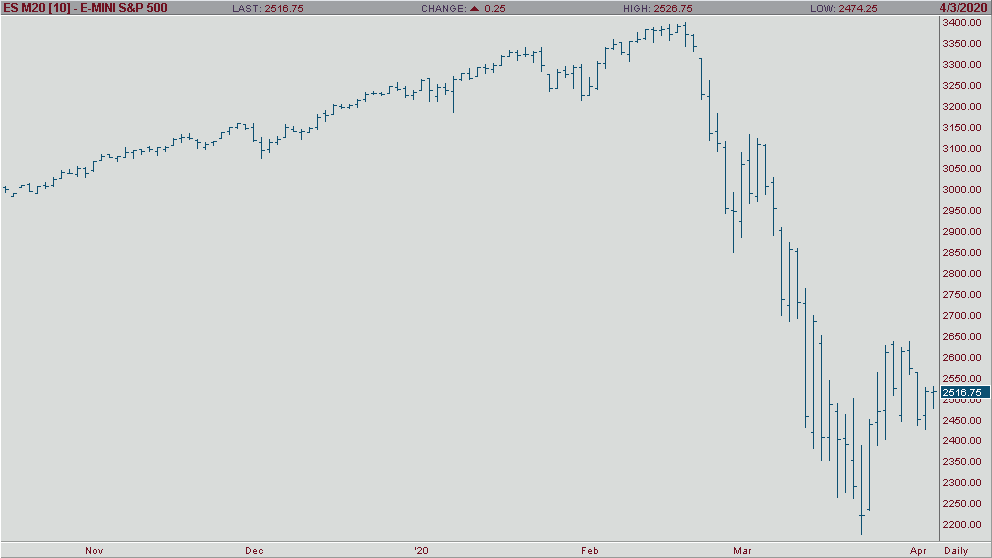

Stocks and Volatility – falling vol in the equity space, I highly doubt that this is the “transition” back into stocks. Implied vol in the SP500 is back to a big fat lazy number of -44% vs 30 realized vol. Downside in the SP500 approximately 11% lower to 2230 this morning.

Unemployment- we don’t really need the data to know what’s happening in the world. -701K Unemployment with a 4.4% rate (this will likely be north of 10% soon – ugh!) – just not good, sad actually.

We’ve got work to do, so I’ll keep it tight this morning. All the Best.