A few things from this weekend’s reading I’ll go over today:

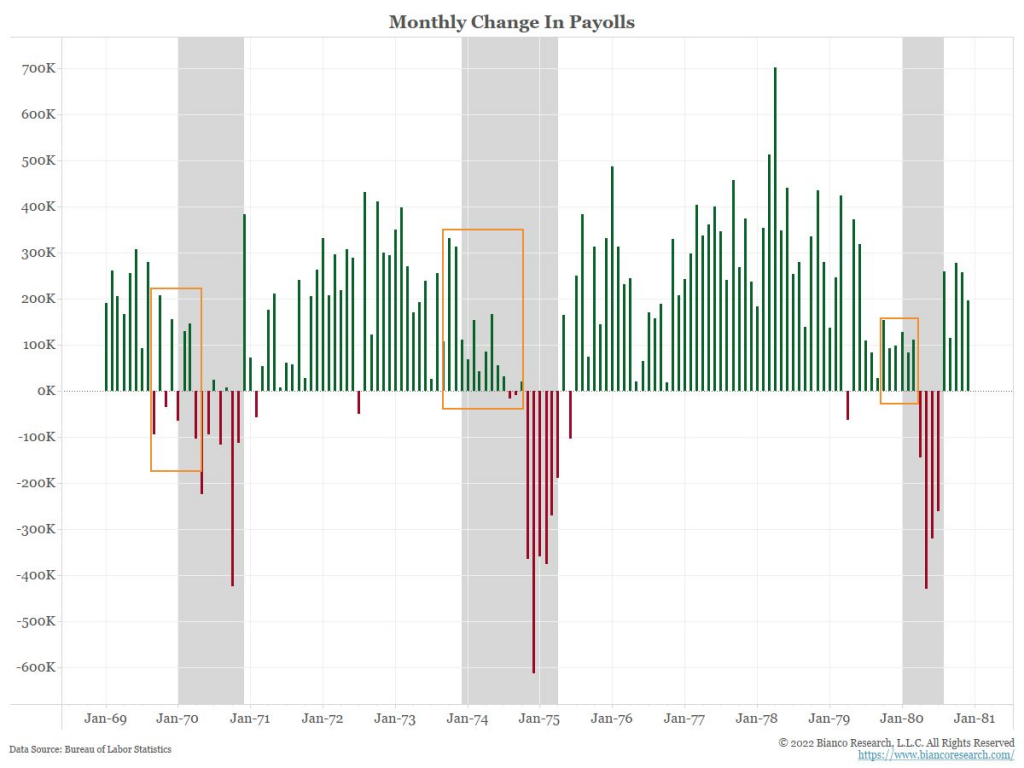

#1. Friday’s payrolls report was a positive 372K (+100K over consensus estimates) – the growing narrative now is that we can’t be in a recession or trending towards one with positive payrolls….Ok. This is false and there’s precedent: The recession of 1973-1974 began with rampant inflation and generally positive payroll growth. However, inflation levels were so high (like now) that the jobs growth couldn’t push domestic growth above inflation. The chart below highlights the payroll data from the 70s – you’ll see 1973/74 showing generally positive payroll growth – but clearly decelerating into 1975.

*Source Bianco Research

So…we’ll find out the answer soon, but ATL Fed currently has GDP for Q2 projected at -1.9%, and projections for this upcoming CPI report due on Friday are projecting 8.8% y/y headline inflation – so even with the positive jobs growth – it (at present) appears to be unsatisfactory for pushing GDP in the correct direction. And yes, another hot reading of CPI appears to be the likely scenario, and the commodity correction will show up in the July CPI (released in Aug).

#2. Before I go into this, let it be known that this isn’t a “base-case” scenario/view that I hold, but something that could certainly begin to develop – and for me it wouldn’t take much to imagine. So, Let’s talk about the US Dollar- could the Dollar’s demise come from a position of strength rather than weakness? We’re already at the point where corporations are beginning to blame the strength of the USD on poor export sales and furthermore, overseas sales once converted back to USD that further shrink profit margins – but we’ve heard this before (2016 most recently). However, unlike 2016 we weren’t strapped with 8.5% inflation and a Fed so far behind the curve you could liken it to the Aesop Fable “The Tortoise and the Hare”. So Dollar strength, while it can express strength of the US Economy, and an increase of domestic purchasing power, it can also be the Sword of Damocles. A weaker USD right now would run counter to the Feds objectives of fighting inflation, but remember other countries outside of the USD are also up to their necks with inflation – but our Fed is clearly overpowering any sense of “hawkishness” from central banks across the pond. The US Economy is 25% of the world’s economy, and 87% of all global transactions take place in USD – so too much dollar strength isn’t just our problem, it can be world’s problem as well. 1985 The Plaza Accord: An intentional dollar-devaluation vs other G7 countries including Japan to reduce trade deficits. Up until that point the strength of the US Dollar was considerable. From 1980 to 1985 the USD had appreciated 50% vs other major foreign currencies. If we’re to move in that direction again – some are beginning to fear that it wouldn’t be to discuss “Dollar devaluation”, it may be to discuss moving away from the Dollar altogether. Again, not a “base-case” scenario, but I stumbled across this in my weekend reading and it gave me reason to pause.

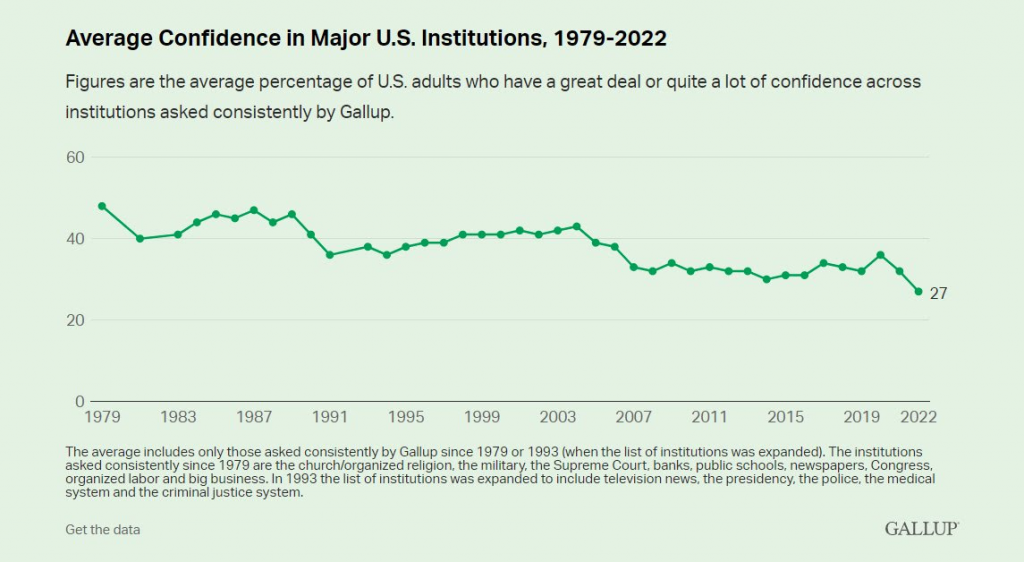

#3. A Crisis of Confidence is taking hold in our major United States institutions. The most recent Gallup poll shows confidence levels at an all-time low:

This poll/chart encompasses everything from our Small Businesses, Banks, Law Enforcement, all the way up to the Federal Reserve, and the Presidency (which showed the largest decline according to the poll). I’m not going to comment on the White House, though there’s plenty of material – but I will hit on the Federal Reserve. Last week the Feds Chris Waller was asked “how the Fed could’ve screwed up this badly”. And in perhaps a moment of weakness, HE TOLD THE TRUTH! “We didn’t do a good job of risk management. We bet the farm on inflation coming down. We should’ve asked, what if it doesn’t come down? We had to do an abrupt and fast pivot to try to catch up”. Ok ok ok, the Fed is behind the curve and in a rush to play catch-up, and devalue risk assets….we get it. But what’s most concerning now, is that after being told that inflation was “Transitory” for over 1 year (Powell “retired” the word transitory at 7.1% CPI by the way)…we’re now expected to believe them (Fed) when they say that they see no risk of a recession. No wonder the Gallup poll on US institutional confidence has moved to an all-time low.

Markets and the Week Ahead:

Stocks- finished last week on a strong note – a bit of weakness here this morning. I can get behind the idea of a little bit higher in the Equity space from here (perhaps 3950-4000 SP500) but I’m struggling to see past there with Q2 earnings season on deck, and CPI, and Retail Sales coming in the back half of this week. I’m not getting classic OB signal yet, and there’s still some higher ground to test in my range analysis as well. I don’t see anything constructive here yet.

Bond Yields – we’re back at 3.10 after a trip back down to 2.75% early last week – so yeah its whipping around. The 10yr yield is carrying negative momentum, and the Fed is likely “all priced in” in bond yields…for now at least. Top of the range is at 3.21%, and the trend remains Bullish.

Gold- Down -4% last week and clearly a disappointment, but I remain contentious that we’re soon to develop a bottom and that this is likely that “washout” phase. The problem with what I just said is that that bottom could be $25-$50-$100 lower… The below chart highlights the median range for Gold prices highlighted in orange: 1880 on the high to 1680 on the low side:

GL,

| Market | Trend > 6 mo | Range Low | Range High | Momentum | OB/OS |

| SP500 | Bearish | 3674 | 3940 | Neutral | 42 |

| Nasdaq 100 | Bearish | 11,142 | 12,288 | Neutral | 56 |

| Russell 2000 | Bearish | 1655 | 1799 | Neutral | 46 |

| 10yr Yield | Bullish | 2.77% | 3.21% | Negative | 95 |

| VIX | Bullish | 24.09 | 33.75 | Negative | 49 |

| Oil (July) | Bearish | 95.83 | 108.86 | Negative | 47 |

| Gold | Bearish | 1726 | 1808 | Negative | 38 |

| USD | Bullish | 105.21 | 107.78 | Positive | 76 |

| Copper | Bearish | 327 | 381 | Negative | 76 |

| Silver | Bearish | 1866 | 20.65 | Negative | 71 |