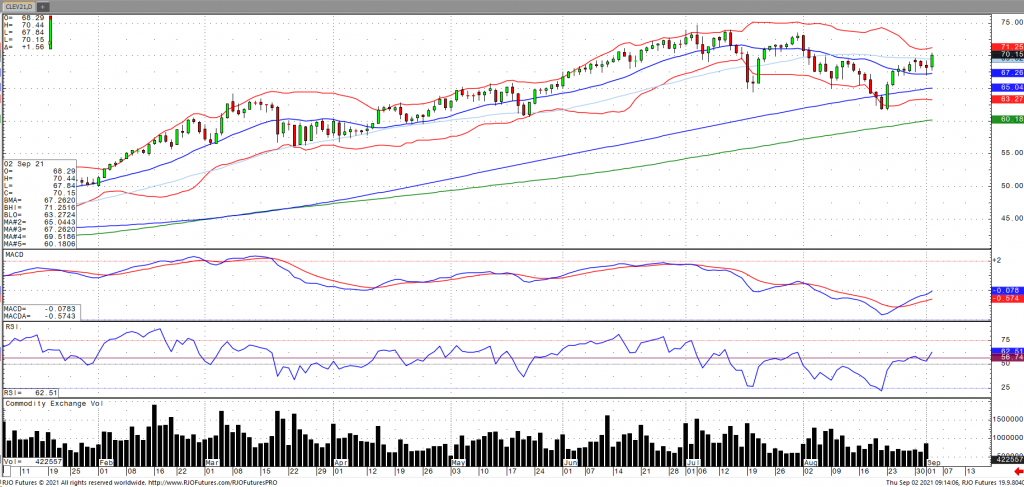

Oil prices are ramping higher as of Thursday morning powered by ongoing concerns regarding restricted oil production in the Gulf with reports of 80% of output still down coupled with a sharp decline in oil inventories. US inventories reported a draw of 7.169 million barrels and are now -73.006 million barrels below last year and -27.795 million barrels below the five-year average. OPEC+ agreed on Wednesday to continue phasing out production restraints by adding 400k barrels per day in October while simultaneously raising their demand forecast for 2022. Further lending support are reports that Russian oil output declined last month as well as continuation in weakness in the US Dollar. The US dollar is now carrying a strong inverse correlation of -0.90 on a 15-day duration. Oil volatility (OVX) has continued to fall into the low to mid 30s with the market remaining bullish trend with today’s range seen between 63.15 – 71.67.