“Clouds are not spheres, mountains are not cones, coastlines are not circles, bark is not smooth, nor does lightning travel in a straight line.” – Benoit Mandelbrot

That’s a quote by BM, the father of fractal geometry. While its human nature to look for linearity in a non-linear world, its just not that simple. Whether you want to subscribe to chaos theory or fractal geometry theory, there’s certainly many intersections, and both are highly correlated to the current mood of the market. Yes, this week was most certainly a “risk-off” week in markets, while we’re looking for more stagflation – there’s been plenty of hemming and hawing over that, and I get it. As we walk a tightrope between the probability of stagflation and risk off Scenario’s, I’ll simply use my market range analysis to help me navigate.

Thursday Look Back and Technical Outlook posted a 2pm CST

Global Equities

USA: SPY -0.92%, NQ -1.25%, RTY -0.85%

EUR: GER -0.53%, UK -0.30%, FRA +0.09%

Asia: Shanghai -1.47%, KOSP -2.56%

Asian equities are getting pounded overnight, following the USA’s collapse late in the day following big tech earnings, and AAPLs downbeat look on iPhone sales. A few day’s back, David Einhorn of Greenlight Capital warned in his Q3 letter to investors that “we’re in the midst of an epic tech bubble”.

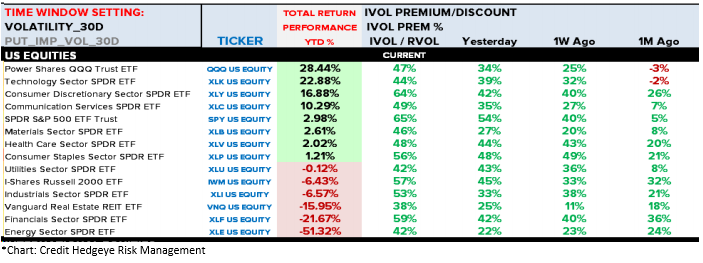

Implied Vols remain at strong PREMIUMS – translation: the Street was prepared for this episode of volatility.

Volatility: The VIX spiked north of 40 this week, and the VXN (Nasdaq Vol) to 43.50. Is this the beginning of a trend or just another episodic battle with volatility? We think its likely the latter, as we’ll eventually begin to reposition and “prepare to compare” the y/y data in Q1 2021 vs the Pandemic data of 2020. But we’re certainly not ready to skip ahead to that chapter just yet.

Commodities have regained some lost ground, particularly the metals:

Gold +0.50%, Silver +0.90%, Platinum +0.55%

Risk assets got dumped on in a big way this week. The US Dollar reflated 1.0%, and the bond market has broken out into a higher trading range. The mood of the market is certainly that of a different tone than we’ve been trained to subscribe too for the past several months, and the asymmetry of the risk environment that we’re currently in may be like nothing we’ve ever seen before. Early next week I’ll do a weekly look back on the percentage changes in risk assets and what to prepare for as next week transpires. Keep calm and carry on, because next week could be a doozy. An oh yeah, Non-Farm Payrolls is due at the end of next week. Buckle up.